does gucci have sales tax | Gucci revenue share does gucci have sales tax For the US prices we used the New York State sales tax at 8.875% as a basis for comparison. As per August 12, 2019 the current rate is €1.00 = $1.12. This is used on all EU prices to compare to US below.

Cannabiotix is a boutique cannabis company based in both California and Nevada founded by two expert cultivators who set out to develop and cultivate the most elite genetics in the cannabis industry today.Finding our dispensary in North Las Vegas, NV is easy. We are conveniently located at 4444 W Craig Road Suite 100-104, North Las Vegas, NV, 89032. Our location offers easy access and ample parking, making your visit stress-free and convenient.

0 · value of Gucci brand

1 · does Gucci accept payments

2 · Gucci value by year

3 · Gucci stock market

4 · Gucci sales and revenue

5 · Gucci sales

6 · Gucci revenue share

7 · Gucci company net worth

The LV-7490 is Canon's first 4000 lumens portable LCD projector, delivering bright and clear images for both small and large rooms alike. This new model has a 2000:1 contrast ratio ensuring images will display crisp blacks with depth and dimension.

Gucci does not have sales, including black Friday sales and private sales. If you see Gucci items, not from an official Gucci retailer, being sold at discounted, sale or clearance prices, then chances are the item is counterfeit. The global personal luxury goods market, of which Gucci is a major player, has grown in value substantially in recent years, rising from 147 billion euros in 2009 to 362 billion euros in 2023. The information in your Gucci profile is crucial to provide you with the Gucci personalized and tailored experience, and in some cases is necessary in order to access to . The largest fashion brand in the Kering luxury empire—which includes Yves Saint Laurent and Bottega Veneta—Gucci delivered revenues of €9.7 billion (.02 billion), up 31.2% from 2020, exceeding.

At the Store: Request a tax invoice from the retailer and keep your original receipt. At the Departure Airport: Bring your paperwork and receipt, as well as the goods themselves. Travelers should have their goods on their . For the US prices we used the New York State sales tax at 8.875% as a basis for comparison. As per August 12, 2019 the current rate is €1.00 = .12. This is used on all EU prices to compare to US below.

1 All prices do not include sales tax. The account requires an annual contract and will renew after one year to the regular list price. Gucci charges sales tax on their products based on where they are sold. In other words, if you make a purchase in a state that has sales tax, then yes, you will be charged .

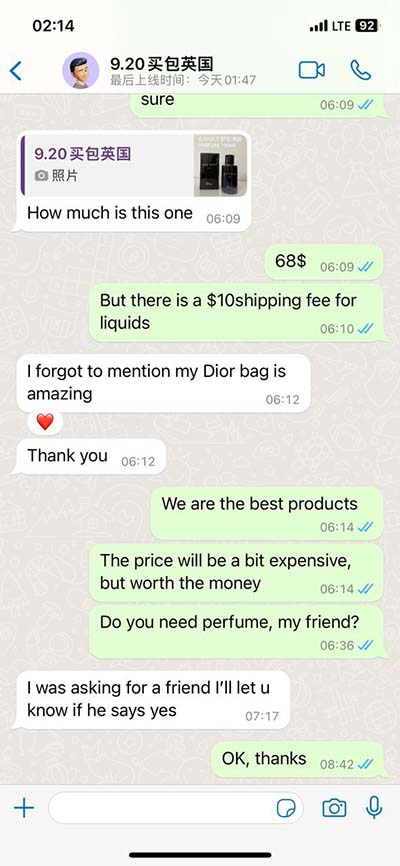

parfum bois d argent dior homme

Does Gucci Charge Sales Tax? Yes, Gucci charges sales tax on all purchases made in their stores. The amount of sales tax charged will depend on the location of the store .Gucci does not have sales, including black Friday sales and private sales. If you see Gucci items, not from an official Gucci retailer, being sold at discounted, sale or clearance prices, then chances are the item is counterfeit. The global personal luxury goods market, of which Gucci is a major player, has grown in value substantially in recent years, rising from 147 billion euros in 2009 to 362 billion euros in 2023. The information in your Gucci profile is crucial to provide you with the Gucci personalized and tailored experience, and in some cases is necessary in order to access to some specific services or to purchase from our website, and thus it needs to be kept up to date for the best experience.

The largest fashion brand in the Kering luxury empire—which includes Yves Saint Laurent and Bottega Veneta—Gucci delivered revenues of €9.7 billion (.02 billion), up 31.2% from 2020, exceeding. Sales tax on clothes varies significantly between states, with different tax rates, tax holidays, and general regulations on the level at which clothing is taxed. In some states, clothing is completely tax-exempt, while in others there are . At the Store: Request a tax invoice from the retailer and keep your original receipt. At the Departure Airport: Bring your paperwork and receipt, as well as the goods themselves. Travelers should have their goods on their bodies or in their hand luggage. For the US prices we used the New York State sales tax at 8.875% as a basis for comparison. As per August 12, 2019 the current rate is €1.00 = .12. This is used on all EU prices to compare to US below.

1 All prices do not include sales tax. The account requires an annual contract and will renew after one year to the regular list price.

Gucci charges sales tax on their products based on where they are sold. In other words, if you make a purchase in a state that has sales tax, then yes, you will be charged sales tax. However, if you make a purchase online from Gucci’s official website and live in a state that does not have sales tax or has no sales tax for clothing items .

Does Gucci Charge Sales Tax? Yes, Gucci charges sales tax on all purchases made in their stores. The amount of sales tax charged will depend on the location of the store and the rate of sales tax for that particular state.Gucci does not have sales, including black Friday sales and private sales. If you see Gucci items, not from an official Gucci retailer, being sold at discounted, sale or clearance prices, then chances are the item is counterfeit. The global personal luxury goods market, of which Gucci is a major player, has grown in value substantially in recent years, rising from 147 billion euros in 2009 to 362 billion euros in 2023. The information in your Gucci profile is crucial to provide you with the Gucci personalized and tailored experience, and in some cases is necessary in order to access to some specific services or to purchase from our website, and thus it needs to be kept up to date for the best experience.

The largest fashion brand in the Kering luxury empire—which includes Yves Saint Laurent and Bottega Veneta—Gucci delivered revenues of €9.7 billion (.02 billion), up 31.2% from 2020, exceeding.

Sales tax on clothes varies significantly between states, with different tax rates, tax holidays, and general regulations on the level at which clothing is taxed. In some states, clothing is completely tax-exempt, while in others there are . At the Store: Request a tax invoice from the retailer and keep your original receipt. At the Departure Airport: Bring your paperwork and receipt, as well as the goods themselves. Travelers should have their goods on their bodies or in their hand luggage. For the US prices we used the New York State sales tax at 8.875% as a basis for comparison. As per August 12, 2019 the current rate is €1.00 = .12. This is used on all EU prices to compare to US below.

1 All prices do not include sales tax. The account requires an annual contract and will renew after one year to the regular list price.

Gucci charges sales tax on their products based on where they are sold. In other words, if you make a purchase in a state that has sales tax, then yes, you will be charged sales tax. However, if you make a purchase online from Gucci’s official website and live in a state that does not have sales tax or has no sales tax for clothing items .

value of Gucci brand

Think of it as a cheat sheet to help you tackle the candy-filled challenges. From clever combos to special moves, I spill all the secrets to help you crush those levels with ease. Candy Crush Saga Level 964 Walkthrough Video

does gucci have sales tax|Gucci revenue share